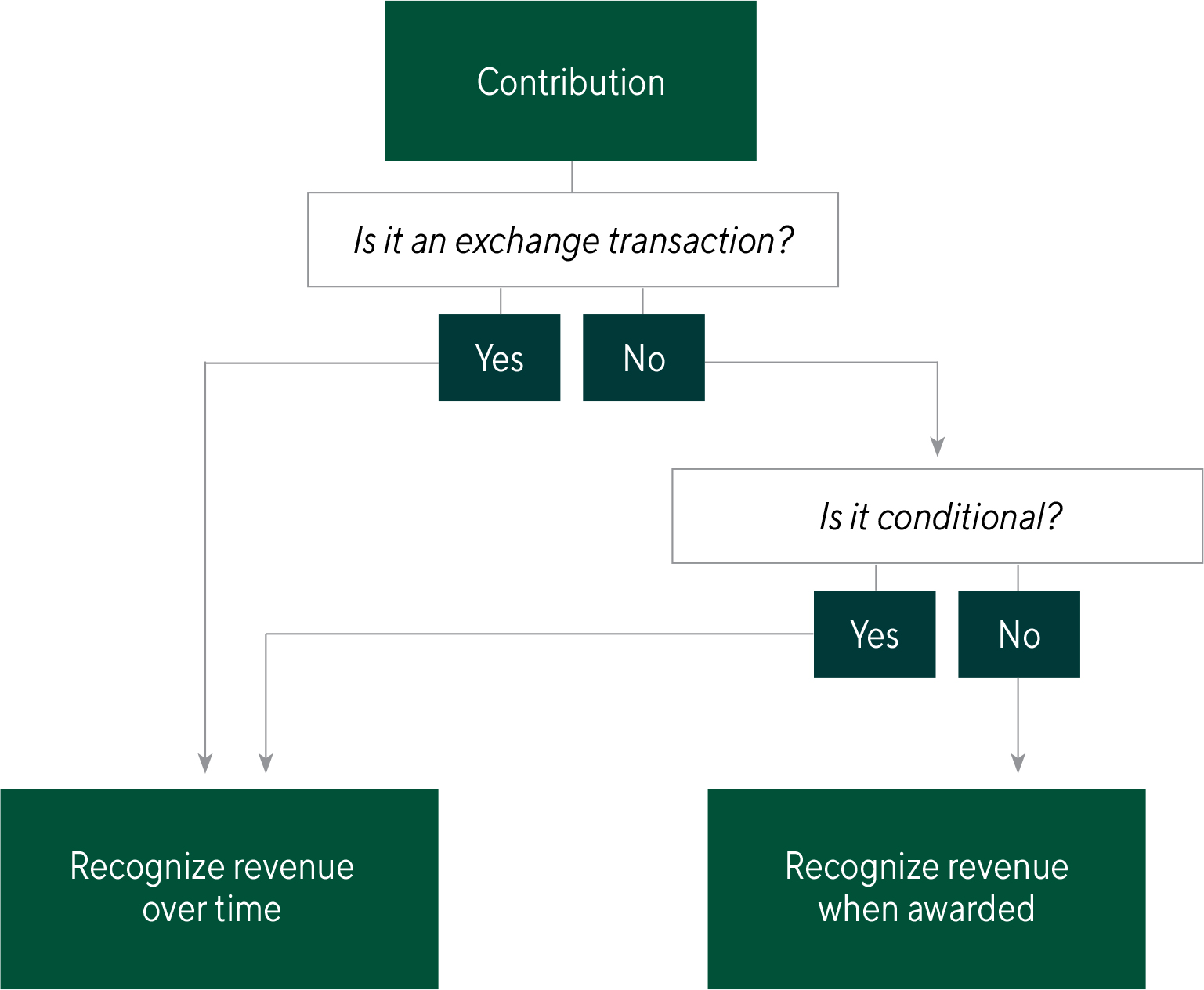

When to recognize revenue can be one of the most challenging areas of accrual accounting for nonprofits. Grant agreements or other facts and circumstances should be reviewed for each contribution to determine the right time to record revenue. This flowchart demonstrates the steps in the process. You can also download a one-pager PDF version of this page.

Exchange transactions are like business activity—the intent is for the resource provider (the donor/funder) to exchange resources for goods or services of commensurate value. Benefits received by the general public, or furthering the resource provider’s mission, do not count as commensurate value.

Exchange transactions (things like theater tickets, museum admission, magazine sales, meals purchased at an organization-run cafe, etc) use the same revenue recognition rules as for-profit accounting: revenue is recorded when or as performance obligations are fulfilled.

Non-exchange transactions are the staples of nonprofit income we know and love: grants and donations. The intent is not to exchange resources for goods or services, and the resource provider (the donor/funder) does not receive commensurate value in exchange for the gift.

Conditional contributions have BOTH a right of return and performance barrier(s) to overcome. A right of return means if certain terms and conditions aren’t meant, the organization has to give back any funds received, or the grantor can cancel the award. There may be a barrier if there are measurable performance-related criteria like a specified level of service, output, or outcome, or if the recipient has limited discretion on the conduct of an activity like specific guidelines around qualifying expenses. Many government reimbursement-basis grants have performance barriers. Administrative requirements like completing a grant report or obtaining an audit are not considered barriers. Revenue is recorded for conditional contributions as barriers are overcome.

Unconditional contributions are recorded as revenue when the pledge is made. The total contribution amount is recorded. For multiyear grants, this means the entire amount is recorded as revenue in the year the grant is awarded.